November 2018 Newsletter: "Sometimes Doing Nothing Is Doing Something"

Did We Really Just Hit "Peak Everything Good" in the market?

Dear Subscriber,

So here we are: the stock buybacks and the earnings reports and forward guidance and the life-changing trade deals did NOT (in most cases) carry the day and right the teetering stock market ship. We did not get the panic selling capitulation with the 30+ reading on VIX fear gauge. The Dems crushed the House and the GOP kept the Senate and added one seat. Our President appears to be having a nervous breakdown (spare me the angry emails brothers and sisters--it is what it is--I do stocks buy stocks are now driven by politics, too unless you have failed to notice. :)).

We are back at key support with failed rallies and IF the S&P 500 Index ETF the SPY breaks below 270--technicals say our bullish inverted head-and-shoulders formation has failed and we revisit 255-257. You see the inverted head and the two shoulders--that formation is supposed to be bullish when the "right shoulder" is on lower volume--until it's not.

Action to Take: IF we get a bottom retest and IF we get the volume and IF we get the VIX fear gauge over 30 or even 40--THEN it will be time to be brave when others are fearful. Of course it's easy to be brave sitting on so much profit and cash. Sitting on your hands and mouse is STILL the safest move until we get SOME capitulation ok?

But first, some necessary housekeeping:

1) ALL updates and newsletters have been added and re-formatted to the www.transformityresearch.com website for review, reflection and pondering amusement. Stephanie the Wonder Webber has taken control--thank God!

2) IF you are wondering where your renewal notice is--it's coming later this week. We extended all the pre-January 2018 subscribers 90 days to compensate them for the transition to the new website and billing system. Later this week you will get a notification for renewal--and our $149 two-year subscription offer ends this year. With 55.3% annual profits from our model portfolio since June 2013--I modestly suggest you take $149 from your REALIZED profits we've made in AMD, NVDA, MU, AMAT, LRCX, MOBL, OLED, Cavium etc and/or the profits on our Option hedges and make sure you don't miss the relative bargain of the 21st century :)

We are still in a race to make profits before the mild recession our Transformity MacroMarket Index says is coming in the first half of 2020--so make sure you are covered when we REVERSE our few longs and go to defensive mode. To extend your subscription, we need you to re-enter your data, email, and password: CLICK HERE and take care of this now while you are on your PC or digital device:

Take Me To The Transformity Research RENEWAL Page NOW!

Otherwise, you will get an invoice in your email later this week. If you want to extend your subscription with the 2-year deal before it ends, no worries--makes sense to me considering.

OK--back to the shit show at hand.

EVERY Capital Market and Sector Has Been Taken Out and Shot--Except Recession Stocks Like Food/Booze and Utilities. What Does That Tell Us?

First off MAN it still feels great to be 78% in cash (and holding big 2018 profits from our 3 GPU data center chip players Xilinx, AMD and Nvidia) plus getting 18-20% dividends from our $10k a Month Club securities and taking all those other profits in early 2018 or late August doesn't it?

But this correction is really about separating the “high quality” factor stocks (balance sheet, cash flow, 3-5 secular growth rates 3-5-10 times the projected 2.25% GDP growth post-2018 corporate tax rate cuts) from the weaker players and ALL the companies with weak balance sheets and refinancing corporate debt in the next 18-24 months.

As I have shared ad nauseum over the last few months, THIS correction is really about the pace and final destination of Fed rate hikes, the recent 3%+ PPI and CPI inflation rates (which are hot and drive tightening of Fed monetary policy) and the confusion about the Trumpian Trade skirmish/battle/cold war. Amazingly, the election played out as prognosticated--the relief rally that polls really do work was a classic surprise double take.

Key point: Stock investors earn superior returns to lower risk bond investors IF they can handle the sharp scary corrections within a bull market. But stock investors make a LOT of money by taking real profits and turning paper profits into cash. Corrections test your nerves and test IF you can take correction volatility or can't stand the pain and bail. The $15 trillion question still remains: 1) Did the market peak for this bull market cycle in the last rally in September or 2) Is this a normal and healthy 10-year bull market correction which, when finished, will give the market enough cash (aka oxygen) to hit an all-time high going into year end and/or January.

top.

I am slightly favoring #2 scenario--but the evidence to assumption #1 is growing like a weed.

When is it over?

When we get a REAL scary 1-2 day 30+ VIX capitulation that shakes out the “sell the rip” sellers and weak hands

Investors come to realize that by definition, the Fed normalization process has brought back “normal” volatility (and the days of an average 10-12 VIX are over—normal has been 15-20 range)

While the bull market correction for growth/tech/SaaS and FAANG stocks continues to wreak havoc –I think it is important to recognize that what we are in fact seeing is a rolling global set of sector and regional bear markets (20%+ downdrafts in value from most recent highs).

This correction does feel different for many reasons--let's add up all the sector issues in order:

The Jan/February correction was driven by profit-taking from big 2017 move/melt-up in January and the meltdown of the “easy money” VIX leveraged ETFs. It was really a flash crash, not a broad-based correction but we did get over 30 on the Vix and earnings season rescued the day. All the leaders beat EPS and forecast projections--Micron, Nvidia, FAANG --and the damage was repaired in less than 90-days

Then the cryptocurrency bubble burst--the most speculative asset ever created and the Millennials money that drove that bubble went to cannabis stocks and another bubble (bubble defined as a "two standard deviation change in valuation over historical trading range") which blew up in October.

The “Emerging Market Stocks” from Thailand to Turkey began tanking as the Fed rate tightening raised the U.S. rising dollar (because so much EM debt is denominated in $$ that paying interest in $$ when your currency is devaluing is very expensive –interest plus currency conversion premium). The Fed raising short-term rates makes the US dollar go up in yield/down in value as we broke the verbotten 3% rate on 10-year bonds.

Then the Shanghai Index headed down 24% on Trumps Trade war, lower y-over-y GDP growth and multi-$trillions of bad debt coming due for public and private Chinese companies

Thenemiconductors—the engines inside the digital economy as basically inside anything with an on/off switch, peaked in May and thankfully tanked AFTER we closed all our positions (except for NVDA and our single remaining AMD/Xylinx position) and semis are now off 22% from recent high

New home sales/housing stocks tanked 20-25% on slowing sales

Auto stocks tanked 24% on higher interest rates and slowing car sales

Banks got what they wanted--a steepening yield curve--and went nowhere and dropped 15%

Then FAANG stocks (Facebook/Appl/Netflix/Google) aka the world’s most crowded trades that drive 30-35% of S&P 500 and 60% of Nasdaq 100 index began to fall apart--especially Facebook with regulatory risk

Then the 2018 big winners: NVDA, AMD, Amazon, and Netflix tanked (AMD still the #1 gaining stock in the S&P 500 for 2018) on profit-taking and Amazon's guidance

Then the cloud-based Software-as-a-Service that miss ANY earnings quarter get 20-30+% schemiessed…look at Yelp or Yext or any second-tier SaaS play (OH I am mad I waited for Twilio to come back to earth--doh!)

Then 21st-century Fintech—Square et al and even Visa/Mastercard

And then giant Apple ecosystem came under attack when Apple said they would no longer disclose quarterly iPhone unit sales and BIG Apple component suppliers like Lumentum disclosed 20-30% canceled orders

Crude Oil prices roll-over and drop 20% in 15 days over global growth issues, Iran oil export exemptions and US/Canadian/Russia oil exports GROWING while demand and supply reverse and then

The rise in the dollar to a roughly 1 1/2-year high adds to the oil weakness (higher dollar makes oil which is priced in dollars more expensive for buyers who have to convert depreciating currencies into dollars). Themost popular ICE U.S. Dollar Index DXY traded up 0.5% at 97.43, representing its highest level since June of 2017, according to FactSet data. It’s also near 10 year highs as well.

A stronger dollar of course, at the margins, hurt sales of multinational companies competing with Euro/Pound/RMB currencies getting cheaper because US goods are relatively more expensive to customers purchasing abroad

Did I miss a sector? Oh year Materials are down 22%, Airlines down 24%.

But when you look at the daily New 52-week highs and Lows, its the defensive non-cyclical stockstthatare hitting new 52-week highs (Consumer Staples,McDonalds,REITS, Utilities, Telcos paying high dividends, Dollar General, ).

Key Point:If you just came back from Mars and were an equity analyst, you would conclude that the United States is

In a recession or 4 months away

Earnings were punk and getting punker

Stock buybacks had been outlawed

But yet our fearless and never wrong Transformity Macro Market Index is POSITIVE at 16.4 meaning risk of recession in the next 4-6 months is less than 5%--so what is happening?

Quick Answer: Either

The market is pricing in a recession 4-6 months out and we are mistaken

For the first time in two decades "Value Stocks" have become the "prettiest girl at the stock market beauty pageant" and will outperform growth like 2000-2001 rotation post Internet stock bubble collapse.

Hedge fund closings/redemptions that must happen by November 15 based on yet another HORRIBLE year of underperformance are starting to create forced liquidations in the Top 50 stocks they all own AND Mutal fund managers closed out losing trade by their oct 31 deadline with the winning stocks everyone owned already

Robotic trading systems base on price and earnings momentum and automated bond/equity allocation systems have kicked in to rebalance index funds and momentum CTA pools that trade price momentum--until it doesn't work and then they bail

Valuations for secular growth stocks are not supportable without the synchronized global growth expansion that is now slowing

The 100+ Venture Capital backed US/China/Europe "Unicorns" aka >$1 billion valuation start-up like Uber and Airbnb are rushing to go public before the window closes and will draw capital from legacy tech firms for the New FANG stocks

The secular technology demand drivers like iPhone units and smartphones in general have peaked and autonomous vehicles and AI robots are not in the near future at scale

Trump's hard-line trade strategy with China fails and comes up empty in talks next week and a full-blown Cold War has started between the world's #1 economy and #2 economy and the 25% tariffs kick in January 2 (and Europe auto tariffs come to the table as well according the White House sources). For some reason, the POTUS thinks that "China" pays the tariffs--don't get me started!

The U.S. Producer Price Index, Wage Inflation and CPI (comes out Friday) are red-lining as 7.2 million job openings with 6 million available labor (and only about 2-3 million of that labor pool is actually trained or qualified for the Manufacturing or skilled jobs available)

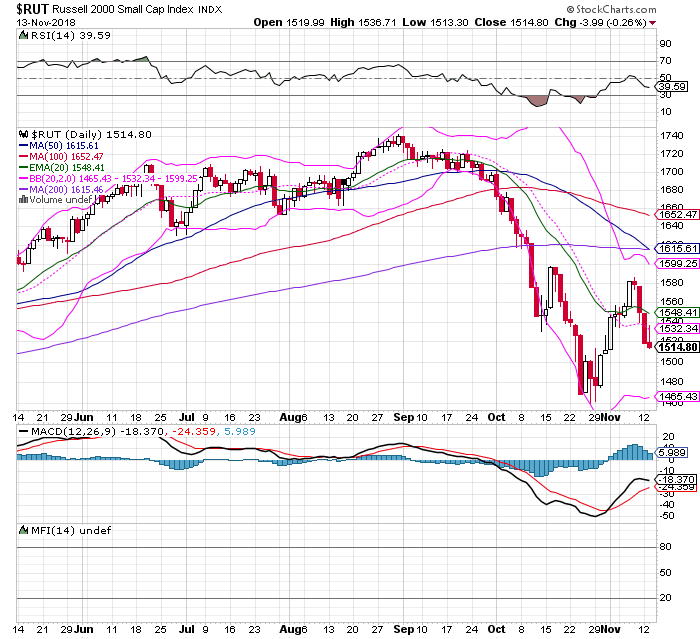

The technicals are collapsing--the Russell 2000 has given us the "Death Cross" where its 50-day price moving average has broken its 200-day moving average. Since the Russell 2000 represents the US-based smaller cap stocks that have LITTLE global exposure--that is worrisome. (see next picture)

Value funds are getting huge inflows while ALL redemptions are in growth funds. During the third quarter, over $6 billion in funds flowed into value ETFs, 24% more than the second quarter; growth funds meanwhile saw a 71% decline in quarter-over-quarter inflows, registering only $1.7 billion in new assets.

ALL the above (except #1)

I'm going with 12) ALL the above. We are ten years into this expansion. The 40% US corporate tax cut added a never before seen booster to public company valuations and EPS at the LAST stage of the expansion (that kind of monetary stimulus comes during a recession to goose the economy--NOT the end.) The second derivative EPS trade has ended (i.e., betting on the rate of the rate of EPS change). The United States is going to borrow $1.1 TRILLION dollars in fiscal 2019 to pay for unfunded tax cuts and under-funded entitlements--how could THAT go wrong? (That is sarcasm for the sarcasm challenged!)

Action to Take: Stock picking is HUGELY important here. Look at Xlynx here--in a semi-conductor meltdown, they are going UP in value and now up 20% for us from $68 purchase price. Their niche is the data center now--and the data center trade growth curve has NOT slowed down yet--Nvidia will tell us the reality Thursday night.

NET/NET/NET: Equities have to be repriced to reflect my ENTIRE dirty dozen list of economic realities. This confusion and repricingdonot happen overnight. The election is a net-nothing at this point (but winter is coming for the Trump Administration--see below). Some sectors have already become historically cheap--semiconductors as a whole now trade at 11 times 2019 earnings--and if Nvidia does not deliver on the 15th they will trade lower. I have strong reason to believe they will--but will put out a hedge tomorrow.

The weaker iPhone cycle is showing the downside of the giant tech companies that now dominate markets. The selloff at the world’s largest company by market cap is also dragging down many in its vast network of component suppliers and manufacturers.

Much of that network is made up of smaller companies that have grown to depend on Apple and its iconic smartphone for a largechunk of their businesses. In a list of 40 Asia-based Apple suppliers, Morgan Stanley estimates that 18 depend on the iPhone for 30% or more of their annual revenue this year. U.S.-based chip makers like Qorvo and Skyworks—both of which supply radio-frequency chips for the iPhone—also draw more than one-third of their annual revenues from Apple. The big companies that supply Apple, like Samsung Electronics ,IntelCorp. and Broadcomaremore diversified, but can still feel the pain of slowing iPhone sales.

Which helps explain why the prospect of a crappy iPhone cycle is bad news for all of tech. For a small device, the iPhone casts a very large shadow.

The Apple Economy is Cyclical & Unit Sales Growth Has Flatlined

Unit sales of iPhones peaked in late 2016, pulled back in 2017 and have flatlined ever since. Barron’s Index of the top 54 Apple Suppliers

Apple is cutting production orders for its latest iPhone models, according to Longbow Research. The firm’s analyst Shawn Harrison said Apple suppliers are shifting production from new iPhone models to older phones.“The iPhone story is showing cracks with contacts now citing weaker iPhone orders year over year,” the analyst wrote on Monday.

Harrison said his checks with Apple suppliers last week revealed order cuts of 20% to 30% for the iPhone XR and XS Max, while older iPhone models such as the 8 and the 8 Plus had order increases of 20% to 25%. He estimates the cuts on the XR and XS Max represent a reduction of more than 12 million units, while the production increase on older models is more than 3 million units.

Lumentum ’s largest customer is Apple (ticker: AAPL), accounting for almost one-third of its sales. Monday morning, the supplier cut its guidance for revenue by about 17%, raising concern about demand for Apple goods and sending its own stock down nearly 30%.

Companies in Apple’s supply chain are feeling the pain. The 54 Apple suppliers Barron’s tracks were down about 4%, on average, by early afternoon. The shock wave from the announcement continues to ripple outward. For instance, Lumentum’s (LITE) own suppliers—companies like Veeco Instruments (VECO) and Fabrinet (FN)—fell about 5%.

Lumentum’s troubles perfectly illustrate the perils of a company relying too heavily on a few customers, but the news also highlights a key reality for the Apple universe.

Key Point:The iPhone has matured. Unit growth is flat and suppliers unit growth is flat. They can't raise the prices any higher. It’s 11 years old and it isn’t growing like it used to. In the past, the iPhone itself was a secular growth engine. Growth in services is well and good for Apple stock, but it isn't a driver of growth at the tech giant’s suppliers.

Really Key Point:First and foremost, they must realize that growth inflections are rocky. The performance of the stocks already tells us that. And stories about excessive inventories will take longer to resolve themselves than in the past. Growth in unit sales of iPhones can’t save the day when demand for a specific model may have been misjudged. It’s likely the iPhone production cuts implied by Lumentum’s news are going to weigh on supply-chain sentiment for at least the next two quarters.

Apple supply-chain investors are also going to have to learn what it’s like investing through a recession. That’s right, a recession. The last time the economy experienced an actual recession, from 2007 through 2009, Apple was shipping about 20 million iPhones annually. The company ships over 217 million units a year now—more than 10-fold growth without experiencing an economic downturn.

Themdays are now over.

Winter is Coming for Herr Trump

To add another ingredient to this witches brew for stocks and confidence, the Democrats are coming for scalps. The market hates uncertainty--and remember the "Pence Put"--if Mr. Trump gets happy feet or the Dems go to full impeachment from the Mueller report, Pence would not change a thing in the Trump economic agenda. I get the best inside on political reality from my old DC sources. But many of them have gone to work for Axios.com--THE premier source. And they tell the story: House Democrats plan to probe every aspect of President Trump’s life and work, from family business dealings, the Space Force and his tax returns to possible "leverage" by Russia, top Democrats tell them.

What they're saying: One senior Democratic source said the new majority, which takes power in January, is preparing a "subpoena cannon," like an arena T-shirt cannon.

Based on our reporting and other public sources, Axios' Zach Basu has assembled a list of at least 85 potential Trump-related investigation and subpoena targets for the new majority. (See the list.)

Incoming House Intelligence chairman Adam Schiff (D-Calif.) told “Axios on HBO” that he expects Trump to resist the committees' requests, demands, andsubpoenas — likely pushing fights over documents and testimony as far as the Supreme Court.

Why it matters: The fight will test the power of the presidency, Congress and the Supreme Court.

Top Democrats, who had largely avoided the subject during the campaign, now tell us they plan to almost immediately begin exploring possible grounds for impeachment. A scathing public report by Robert Mueller would ignite the kindling.

Tom Steyer, the liberal activist who spent more than $100 million during the campaign to build support for impeachment, said establishment leaders who are trying to postpone talk of impeachment are "the outliers": "80% of registered Democrats think ... we're right."

Two of the most powerful incoming chairs tell "Axios on HBO" that they are plotting action far beyond Russian interference in the 2016 elections.

1) Schiff, the top Democrat on the Intelligence Committee, told us he wants to help special counsel Robert Mueller and plans to release — with some redactions of classified material — transcripts of dozens of interviews the committee conducted during its own Russia probe.

Schiff says these transcripts contain numerous possible contradictions with other testimony and facts that have come to light, meaning possible legal jeopardy for the witnesses, who have included White House officials and alumni.

"I want to make sure that Bob Mueller has the advantage of the evidence that we've been able to gather," Schiff said. "But equally important: that Bob Mueller is in a position to determine whether people knowingly committed perjury before our committee."

Asked if there are real questions about contradictions between the testimony of Roger Stone, a close ally of the Trump campaign, and emails that have surfaced since then, Schiff said: "That is certainly the case."

Schiff said: "We're going to want to look at what leverage the Russians may have over the president of the United States."

2) Incoming House Appropriations Chair Nita Lowey of New York, a close ally of House Democratic Leader Nancy Pelosi, said "yes" to each of a long list of possible investigative targets, including the Space Force, hurricane relief in Puerto Rico, White House security clearances, White House use of personal email and more.

"We have our boxing gloves on," Lowey said. "I'm ready. And so is Nancy."

See the clip of her answers.

We reminded Lowey and Schiff of a Jonathan Swan scoop from August, "Republicans secretly study their coming hell," reporting that House Republicans had built a spreadsheet of potential investigation targets, based on Democrats' public complaints and statements.

Both Lowey and Schiff made it clear that the GOP list is just a starting point.

So look for probes of James Comey's firing; Attorney General Jeff Sessions' ouster; the Muslim travel ban; family separation policy at the border; discussions of classified information at Mar-a-Lago; administration dealings with North Korea and Saudi Arabia; and so much more.

Trump is already signaling confrontation, saying at his post-election news conference that if Dems investigate him, the result will be "a warlike posture."

Asked if he'll investigate the Democrats back, he replied: "Oh, yeah. Better than them."

Be smart: For 225+ years, federal courts have upheld the Constitution's mandate of Congress as an equal branch of government, providing checks and balances on the executive. So House Democrats have a high hand as they assume power.

Final Point-It's That Time of the Year to Be GRATEFUL

Look I know by the angry emails I get from a few subscribers that my negative view of our POTUS politics and judgement is not popular with some. But we are investors--and now politics is an analytical factor. While the overall market is NEGATIVE 1% for the year--we have captured over 75% profits with just our closed out positions (thank you 3 AMD positions at 175% profits in 2018 alone--many of you were in at $5 and IF you took our advice to sell at $28--you made 40 years of wealth in 2.5 years).

We are smiling while the rest of buy/hold/mold "investors" lick their wounds.

Let's be grateful and humble and by all means NOT be greedy or rushing into the great unknowns at the moment. There IS a time to be brave in stocks--the times we bought AMD under $5 or at $10 on giant pullbacks or MU or Nvidia and many others...THAT is the time to be brave.

But if you have NOT picked up my vibe yet--we have at least 12 major reasons to be a LOT more cautious here. When I was the publisher of 8 major newsletters at Phillips Publishing or my J/V with Phillips with ChangeWave Investing...I HATED it when my editors gave a rosy outlook during economic and sector meltdowns without any better insight than "It always pays to buy stocks'.

Bullshit. Many of those editors did NOT survive 2000 or 2008--they were Johnny one-note fellas who considered it a sin to sell a stock.

While we head into the holiday with our "bag full" of profits, let's not forget how fortunate we are. I have found supporting the homeless in and hungry children in my new Arizona home plus wounded Veterans in my region a very special way to give back our good fortune. I know you all do your part as well. But let's be very generous to those less fortunate this year shall we? I will be the first to say we got VERY lucky on AMD and the 150% move from $11 to $30 in 20 trading days--that does NOT happen.

There are some people in your neighborhood that are suffering--the smiles you bring to them will pay YOU a dividend that is worth so much more than money.

Peace out!