Cloudera Update and AMZA Double Down

Dear Subscriber,

Cloudera has really made a remarkable transformation over the last 5 months. Their new cloud-based and premise-based platforms for Machine Learning, AI, and Data Analytics are now ALL released and will start to really ramp subscription revenues staring in 2020 and building into 2021.

According to CEO Martin Cole "Sales cycles have remained relatively stable this year. They're typically; call it six to seven, eight months for most of our transactions. The recent announcements have given greater clarity. I would expect that as we head into next year, we would start to see a marked improvement in sales cycles especially for things relating to the Public Cloud."

I expect the CLDR analysts on the Stree to upgrade $12 targets to $14-$16 with this new data for their valuation models.

JMP Securities analyst Patrick Walravens has also just gotten on board. “We see a number of potential catalysts for Cloudera… most importantly, the phased rollout of the new Cloudera Data Platform, the first milestone of which was achieved last week when the public cloud edition was made available to select customers; this should allow Cloudera to begin to participate in the white-hot market for cloud databases, which Gartner estimates reached $10.5B in 2018, up a staggering 87% year-over-year,” he explained.

I encourage you to click here and read the earnings call with CEO Martin Cole--But what really has me excited for Cloudera is their leadership in the "Next Big Thing" technology called "Kubernetes". Here is a quick primer on Kubernetes and why they are so important to Cloudera. I expect to seel UPGRADES to Cloudera price targets to the $14-$16 range in the coming weeks.

As they said on the CC: "We release our Private Cloud next year which will have which is completely based on Kubernetes and containers and we bring to market all our offerings, machine learning offerings and so on running on Kubernetes that cleanly attach to our new CDP Data Center. So as a result what you see us doing is executing on this Enterprise Data Cloud strategy starting with Public Cloud now we have taken the first -- we've done half the step, if you will, on-prem and then we'll finish this next year with CDP Private Cloud on Kubernetes and containers."

Action to Take: BUY Cloudera on any pullback under $11 with $14 target by 2021 "

The Cloud Native Computing Foundation (CNCF) is the non-profit foundation that owns the Kubernetes trademark and hosts the Kubernetes open-source project. Kubernetes, as Barron’s explained recently, is making the cloud far more useful for running cloud-native applications. The Greek word for helmsman or pilot, Kubernetes is accelerating the transition from legacy client-server technology to the cloud.

Last month, more than 12,000 developers and executives (and a number of our Transformity tech experts) gathered in San Diego at the largest annual Kubernetes conference called KubeCon, run by CNCF. That’s up from just 550 attendees four years ago. The developers are looking for ways to take advantage of Kubernetes and its management of containers stored in the cloud. CNCF is a subsidiary of the Linux Foundation, which supports the open-source Linux operating system used in PCs, enterprise servers, and in the cloud.

Containers hold an application, its settings, and other related instructions. The key to the container is that it’s essentially a free agent, not tied down to one operating system and able to run across different clouds. Google long ago developed software called Borg to orchestrate its in-house containers for apps like Gmail and Google Maps, spinning them up and down as needed. In 2014, the search giant opted to make a version of Borg open source, calling it Kubernetes. Today, the major cloud providers all offer a Kubernetes option to customers.

Here is Barron's convo with Dan Kohn who is the director of the Cloud Native Computing Foundation for your edification on Kubernetes.

Barron’s: What’s the history of Kubernetes and the Cloud Native Computing Foundation (CNCF)?

Dan Kohn: The history here is that Google originally created the [Kubernetes open source] project back in 2014. The company brought in developers from a number of other companies – Red Hat, IBM (IBM), Huawei and others. They wanted to get more adoption. So they said, who can we transfer the trademark to ensure that there would be neutral governance around this project and there’d be a fair way of deciding to use it for other sorts of things. So they came to the Linux Foundation and the Linux Foundation set up CNCF.

Why is Kubernetes such a sea change in computing, and why has it gained so much traction over the last few years?

The idea behind Kubernetes is to leverage the last decade of innovation. This is where the term container comes in -- the idea that you wrapped each of your microservices into its own container. Instead of hiring a team of system administrators -- dozens or hundreds of people whose job it is to keep track and to make sure that all of those things are running within the rules -- you program your rules into software. And then Kubernetes is the platform -- the term is orchestration engine. It is the orchestrator that is making sure that all of your software is running the way it’s supposed to.

What are the key advantages of Kubernetes versus older models of computing?

There are three big advantages. The first one is resource efficiency, and this is the idea that by breaking up your application into lots of different pieces, running just the way they need to, you can run the same workloads on a smaller number of servers.

Number two is a higher development velocity. When you had one big monolith, it’s extremely difficult to make changes to it. But when you can break it up into microservices, each team can be responsible for its own part and can have it improve at its own rate. And that allows the whole system to improve much faster.

And the third one is about portability in the hybrid cloud -- being able to move your workloads and not being locked into a single provider or a single vendor. Also one of the huge strengths of open source is that you ultimately have control over the technology your businesses rely on.

Are these key advantages of Kubernetes accelerating the trend to cloud-native software development and cloud computing in general?

Definitely. Kubernetes ensures that workloads get the resources that they need. We’re just seeing that adoption accelerates among our members, and we now have over 130 end-user companies using these technologies [and paying dues to the foundation]. So it’s folks like Apple (AAPL) and Ant Financial, which does Alipay. It’s a pretty spectacular group. We’re seeing that story of cloud-native adoption very consistent between them. [Note: Kubernetes is open source, so any company can use it for free without being a CNCF member.]

Who are the top contributors right now who are contributing the most to the Kubernetes project?

There are 35,000 individual contributors, over 2,000 companies, and 1.1 million contributions. We list the top eight contributor companies –- Google, Red Hat, VMware (VMW), Huawei, Microsoft, IBM, Fujitsu and a startup called Weaveworks. Google’s contributions continue to go up, but their percentage as a whole has been consistently going down, as all these additional companies have gotten involved. (Note: the combined Cloudera and Hortonworks is a Top 15 contributor)

AMD Nothing has changed in our AMD Price Target $50 by 2021. Buy Under $36

Many of our subscribers how 1000%+ profit in AMD from our original <$3 buy under advice.

In the short term AMD has some technical issues: AMD trading on its 20-day MA and 12% above its 50-100 day key support between $34-$36

Now only someone with no tax issues would sell AMD at the end of the year. You can protect your profits in AMD aka collar your profits into 2020 by SELLING a Jan 10 $40 call for >$1 and buying a $37 put option for around $1 IF AMD breaks its 20-day MA at $38.50 and closes under $38.50.

Officially we will use the short term collar for the portfolio IF we get that clean break and close below $38.50. The reason is some of the black box algo machines will auto sell their long positions with a clean break on above-average volume.

AMD Next Stop $50 by 2021

From this point on, AMD has created a massively refreshed and much richer product mix of CPU s and GPUs which challenge both Intel and Nvidia (NVDA) head-on. They are taking market share in high-end server products so that AMD can increase its profit margin to 44%-45% without giving up the low pricing advantage on the low-end products. For the first time of a long time, AMD finally has a decent chance to grab a meaningful share of GPU market from Nvidia (NVDA maintains its monopoly is high-end gaming, AI data center and autonomous vehicles) and AMD gains CPU market share from Intel in notebooks (who is chip output constrained) that deliver higher EPS profitability at the same time.

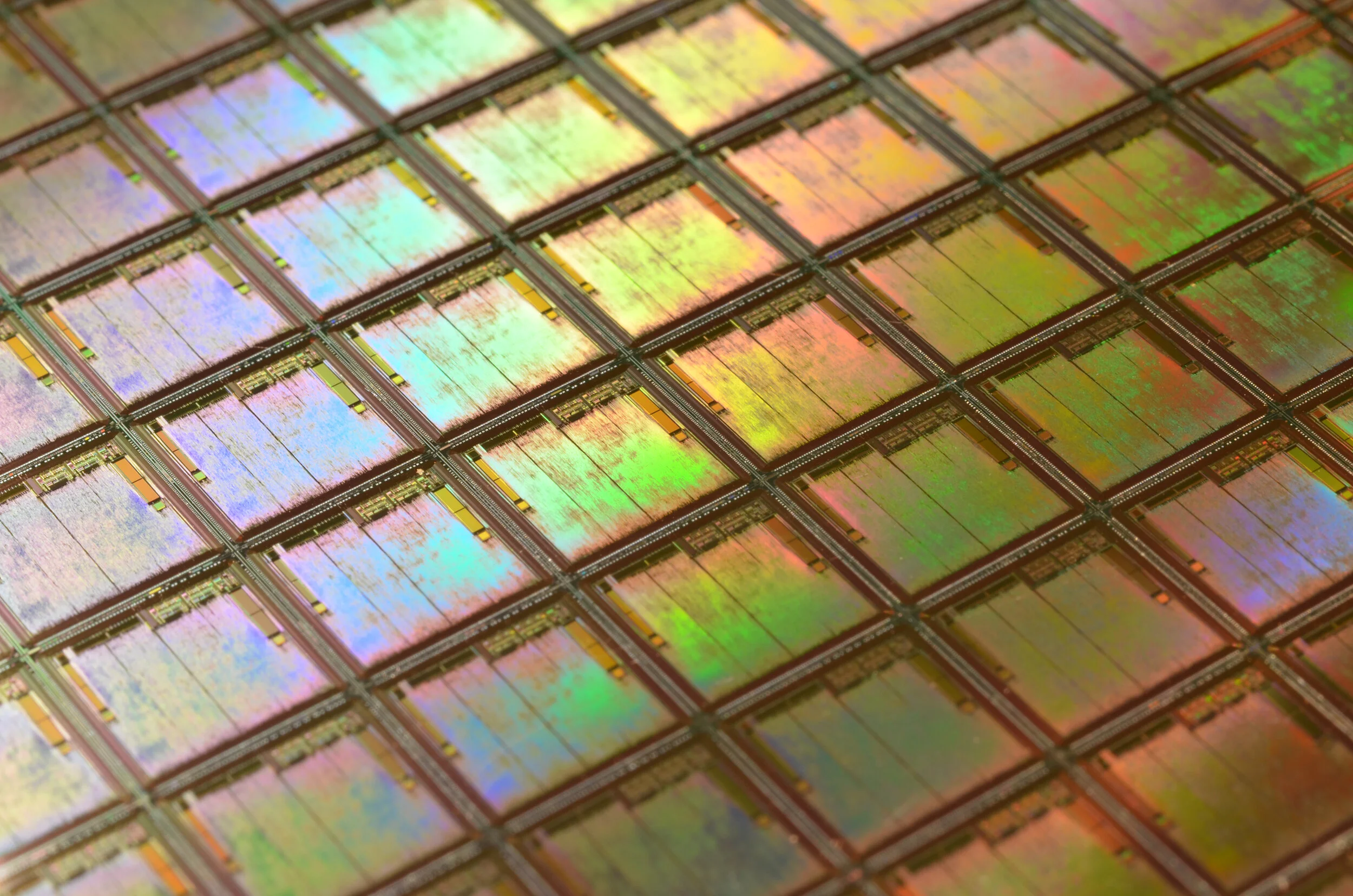

Remember, the chipmaker launched its new Zen 2 family of 7-nanometer (nm) CPU And GPU processors in July and they have market share traction every since. Its main competitor Intel primarily offers 14nm desktop chips. Smaller-nanometer manufacturing processes from Taiwan Semiconductor (TSM--which we are adding on next pullback) allows AMD to create faster, more power-efficient chips. Last week, Nomura Instinet analyst David Wong noted AMD is gaining a big market share in many of the key computing categories against Intel. “AMD’s share momentum continues,” he wrote. “AMD gained impressive share in the data center, desktop, and notebook processors in the September quarter.”

AMD reported clean "meet and meet" earnings results for Q3 and Q4. We see increasing 2020-2021 sales and market share expansion on broad-based desktop, data center server deployments continued notebook traction, and the new game console ramp-up cycle starting June 2020 where AMD GPUs are in the next-gen Microsoft and Sony Playstation consoles (with Nvidia in Nintendo).

NetNet: As a result of all the above, AMD is in a "remarkable position" to gain share in every segment next year," while spending less on R&D, according to analyst Joseph Moore. AMD will also have new opportunities in IP licensing (read China), semi-custom solutions (read China), cloud gaming (read Microsoft and Google), and supercomputers. Furthermore, more indications surfaced that Intel's (NASDAQ: INTC) 10nm Ice Lake and Cooper Lake server technology may not be easily scaled, nor competitive with AMD's 7nm Rome.

It has been a life-changing run for many of our subscribers--but it ain't done yet.

AMZA Double Down Action to Take: Double Down Under $4.20

With MLP shorting by hedge funds finally drying up for their year-end profit-taking, and the Saudi Aramco IPO pricing tonight (which in my mind means they will do WHATEVER it takes to get crude oil over $60 and stay there) it's time to double down on AMZA with a $5 target. REMEMBER--AMZA is on-track to lower their monthly dividend at one cent in January--but AMZA is an ETF that is priced on the value of its underlying MLPs and stocks, NOT THE DIVIDEND.

The main MLPs they own (55% of the fund) are as follows (and these MLPs are 45-60% LOWER in valuation than their traditional 11-12 times EBITDA and all have 130%+ coverage on their dividends). These MLPs have been the easiest bear raid targets for short hedge funds all year. They are insanely undervalued at the same time the big Private Equity funds are sitting on $1 trillion in cash and $trillions more in debt capacity to take these big players private (see Tallgrass Class A at 12-13X EBITDA buy out by Blackstone).

ET - Energy Transfer LP

16.15%

MPLX - MPLX LP Partnership Units

14.00%

EPD - Enterprise Products Partners LP

12.65%

PAA - Plains All American Pipeline LP

12.21%

WES - Western Midstream Partners LP

7.48%

TGE - Tallgrass Energy LP Class A

7.30%

DCP - DCP Midstream LP

7.03%

MMP - Magellan Midstream Partners LP

6.93%

BPMP - BP Midstream Partners LP

6.64%

At these prices, this is a no brainer. Later US crude oil prices go above $60 as I expect, I will use put options on the XOP ETF to hedge our downside (but continue to generate 20%+ yields). For my own taxable portfolio I am establishing a leveraged position with 33% margin--and I will use the XOP to hedge any downside and roll the XOP put options for the duration of the trade.

The math? I am locking in about 10 cents a month in distributions from a $50k investment (assuming AMZA goes down to 7 cents a month distribution of 84 cents per year in Jan 2020) with 11,700 shares--7,000 with cash and 3,300 owned on margin at 4.25% at Interactive Brokers (the ONLY broker to use margin--Schwab is 7.2% on $100,000--outrageous!)

$500,000 with cash and margin gets you 10 cents per share on 120,000 shares or about $12,000 a month FYI. You MUST use out of the money XOP calls to hedge this play--I recommend the $19 January 2021 put options $2 or lower.

Trumpian Psychoanalysis

Here is what many are missing about Trump is Trumpian psychology IMHO and the December 15 phase on deadline with China. I have known and interviewed DJT many times for Fox Business; here is what I know for 100% certain.

1) by now the entire world must know that he has a sociopathic need for attention and to be the Alpha male in every room that has a camera.

2) He sees the POTUS job as both the protagonist of a 24/7 daily TV reality show and the antagonist anti-Beltway crusader character at the same time--he just switches characters--and many times a day. Given that reality TV show production context, his behavior is easy to understand. But the third point is most important

3) As a functional sociopath (like many of America's POTUS's BTW), his instinct is to do what is he feels is most beneficial for him above all else because that is his narcissistic personality disorder and human nature whispering into his ear.

Conclusion: Don't watch the drama--watch what he actually does. What he actually does is perform as the Anti-Beltway Anti-Deep State protagonist crusader for his base, and does what he thinks gives him the best chance for re-election in 2020. What is best for his re-election prospects is to NOT suck another $115 billion in tariffs from the pockets of his base--remember he is a base politician- nor does him any good to tank the stock market while the Fed can't be blamed (they are on hold through 2020 unless the trade war ramps up to a higher more dangerous level.

But just in case I'm wrong, you can buy the $18 VXX Call Option under $1 for Dec 20 expiration to hedge your equities if you are worried. I bought the 25 Call option for 10 cents today on the open basically for the helluva it--it closed up 60%--big whoop.

In short: As usual, Mr. Trump is trolling China and the media for camera time and posturing. Nothing to see here

Sell Stop Sales: We closed out losses on Bloom Energy as it broke our $5 hard sell stop and took profits on Xilinx at $90 (originally on buy list at $55)

PS--My Latest Book FOXOCRACY: Inside the Network's Playbook of Tribal Warfare

If you are curious as to what really goes behind the camera in the Fox News opinion programming productions and or have a close relative or friend that has started to get on your nerves with his/her Fox News addiction...my book makes a great holiday gift!. It's on sale this week at Amazon--they sold their first printing out in 10 days (taking a bow now).

Click here to buy the book!

Cheers!