September Ultra Growth Newsletter Part 1--Expanding Positions in the ENTIRE AI Technology Ecosystem

The Macro: The easiest prediction ever was that the Fed would implement a 25-bps Fed Funds Rate cut, and that the new Governor, who still works in the White House, would vote for a 50-bps cut. Obviously, all the above was mostly priced into the SP 500 and Nasdaq 100. And Q3 earnings season for the AI Infrastructure Ecosystem does not start for 4-5 weeks.

Thus, this week from a macroeconomic sense is a nothing burger-Manufacturing and Services Purchasing Manager Index (PMI & Services PMI) and existing and new home sales (won’t get going till 30-year mortgages are down two+ percent--come on, Jerry--put your Alan Greenspan rate cut hat on!)

Thus, our inferred reality for the Q4 stock market direction MUST BE :

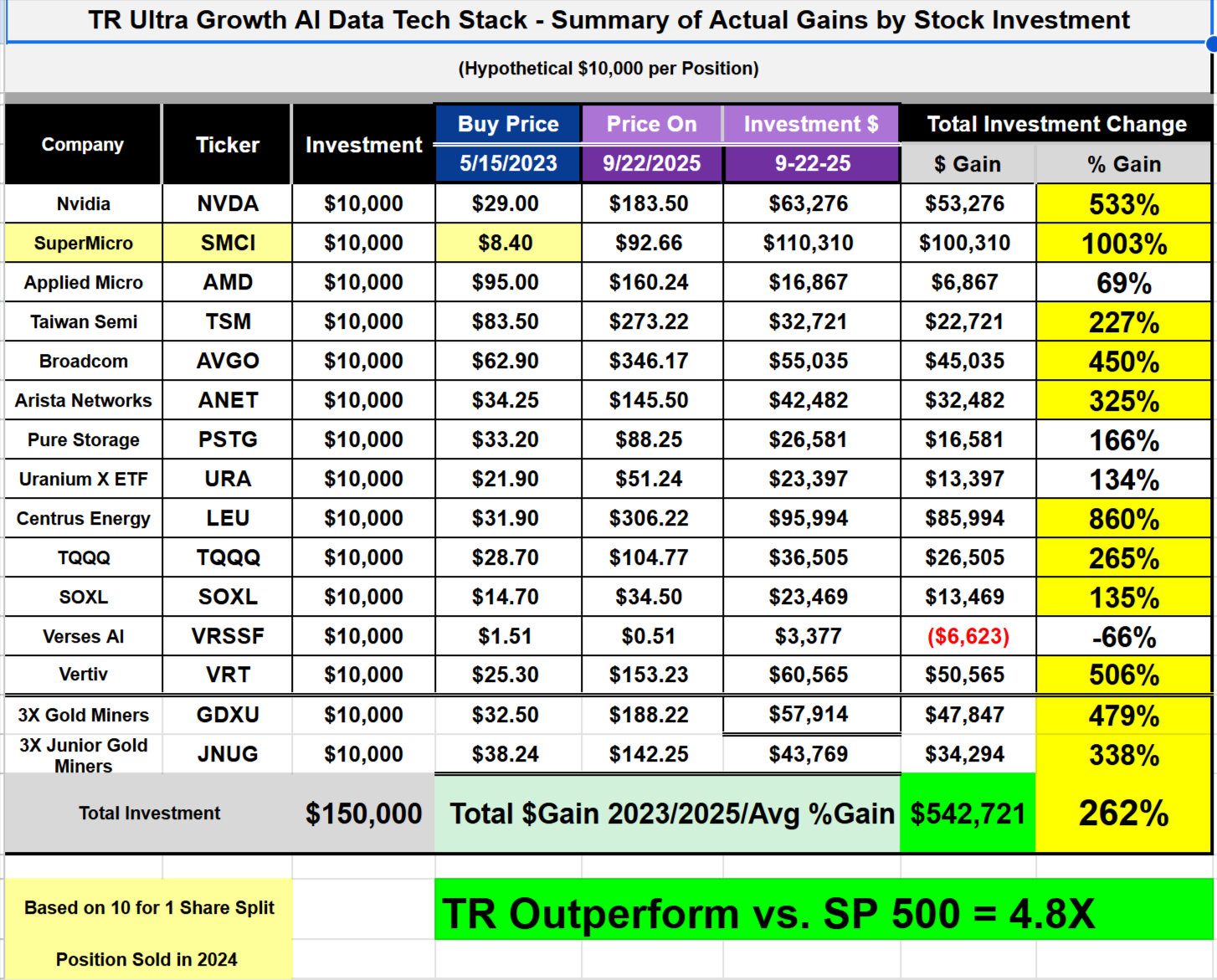

The EASY Money in our CORE AI Data Center Tech Stack Stocks Has Been Made

We should expect a period of SOME price consolidation of the winners into the Q3 earnings season

Key Point: We are adding a massive set of NEW AI micro-ecosystems that are direct and indirect beneficiary sectors and sub-sectors that have YEARS of 20-40%+ secular growth (see below)

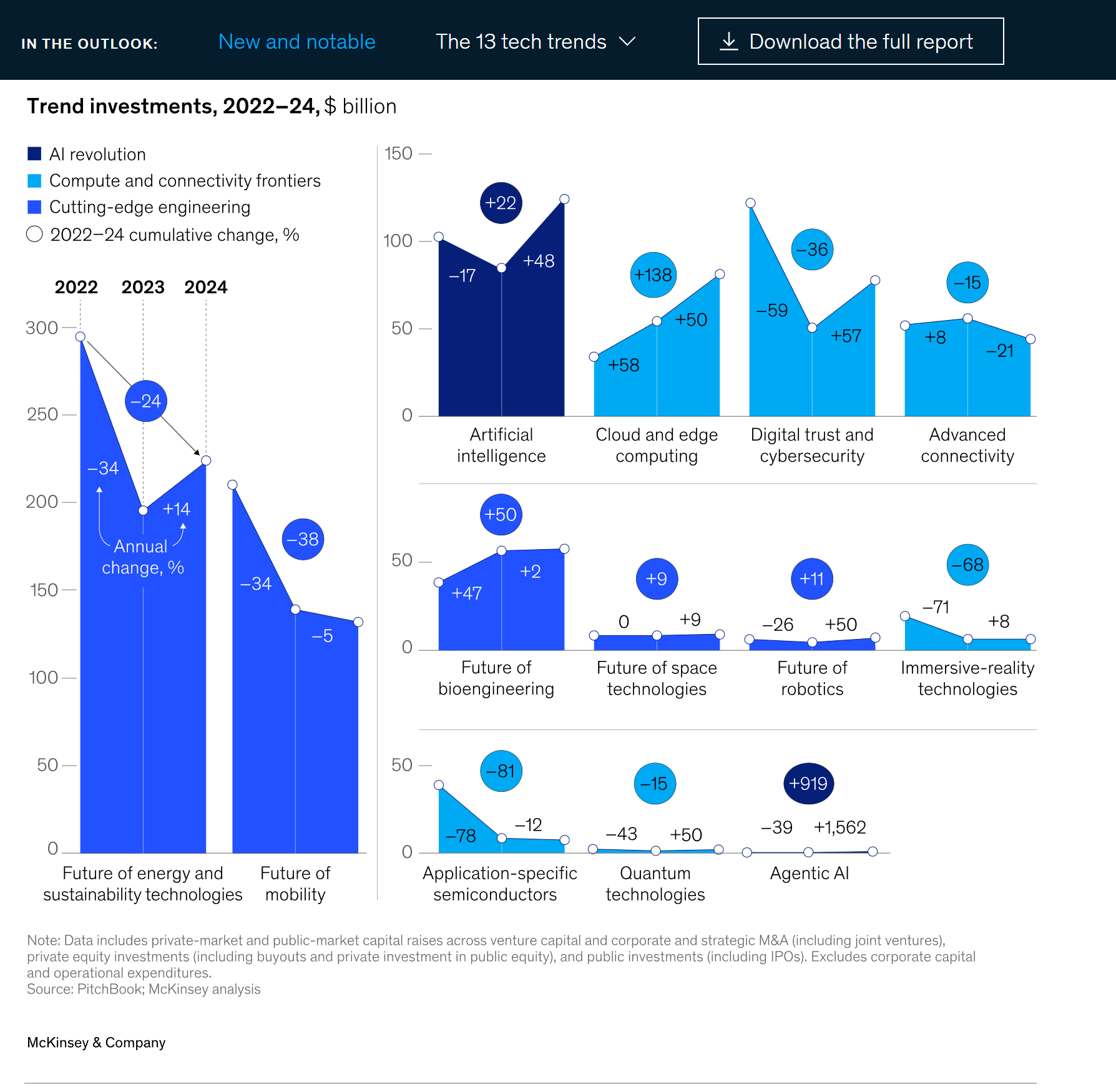

Key Point: The latest McKinsey Report on AI-Related Sectors is a fantastic read and roadmap for any AI sector investor.

Here is the link to their report that you must read.

Actions To Take:

IF you are looking to take some profits to add new sectors--take some capital gains profits (or use 5% below Market Sell Stops) on $NVDA $AMD $BRCM $LEU $VRT or $SMCI if you still hold it

HOLD ON TO $GDXU $JNUG and $SLVO $GLDI in our Ultra Income Portfolio-- the Gold and Silver miners are still WAY TOO CHEAP versus their proven extractable gold and silver reserves--and

ADD 2X Silver $AGQ ETF and 2X Silver Miners $SILJ

Yes, it turns out that a whole lot of silver goes into the AI Data Center networking components — servers, high-speed networking, cooling systems, and PDUs (power distribution units) — with large data centers consuming 20-40 kilograms of more than 45-90 pounds per data center.

Top Individual Gold/Silver/Copper Miners To Own (Note: I still prefer the 2X Miners ETFs in the precious metals space--they have crushed the underlying stocks in this extreme dollar depreciation-fueled gold and silver meltup!).

We own these precious metals for two reasons: 1) the historic devaluation of the $US Dollar vs. other key world currencies, and 2) the supply vs. demand imbalance in the industrial silver market

How much has the US dollar depreciated against a basket of the major world currencies, you ask?

-11%! That is the worst performance for the dollar in over 50 YEARS!

The fact is that major global investors and central banks have shifted their cash reserves to other major currencies. Why? Because they RIGHLY perceive other major currencies are safer than the US dollar post America’s “Liberation Day” tariffs and the general USA economic slowdown with unemployment RISING and consumer goods and services inflation staying sticky (been to the supermarket or gas station recently--or got your credit card bill from a recent Europe trip ???) + future Fed Fund rate cuts make US bonds pay lower rates.

Hundreds of billions of US dollars and dollar-denominated bonds are being sold by global central banks and replaced with gold bullion that is appreciating as the US dollar's value falls at a record percentage.

What does a savvy investor do with a falling US dollar? YOU DO WHAT WE HAVE BEEN DOING--YOU BUY GOLD and SILVER miners where their proven reserves are valued 30%+ BELOW their market value of their gold/silver out of the ground!

Here are a few individual gold, silver, and copper miners that we continue to see as 25% undervalued for you who prefer to own the miners outright (and sell put options against them--you know who you are :).

Silver

Hecla Mining Co $HL

First Majestic Silver Corp $AG

Copper--McEwen Inc $MUX

Copper/Gold/Molybdenum: Freeport-McMoRan $FCX

Gold

OR Royalties Inc $OR

Seabridge Gold Inc $SA

Wheaton Precious Metals Corp $WPM

Next Play . . .

ADD High Bandwidth Memory $Micron $MU before earnings out AFTER market today to our $SOXL computer chips play and ADD Data Storage Western Digital $WDC + Seagate Technology $STX with Gartner estimate hard drive sales at $24 BILLION in 2026, which is double 2023

Oracle is the “New Nvidia”-- ADD $ORCL ⅓ Position and Finish with any pullback/sell off (more on Oracle further in Part 2 of this report )

When it comes to BUILDING AI Data Centers in North America, BUY Sterling Infrastructure $STRL $TTMI and Fluor $FLR, which is the premier engineering/procurement/construction company in the AI Data Center built out (and happens to own 50% of the $SMR aka NuScale Power the “small module nuclear reactor” player)

When it comes to POWERING Data Centers TODAY, BUY the low-cost power providers + zero-carbon nuclear power providers are preferred by AI Data Centers and HyperScalers: Constellation Energy $CEG, Vistra Energy $VST, and $NRG Energ,y and $OKLO, the only SMR player backed by OpenAI and

AFTER the nuclear technology company held a groundbreaking event for its first Aurora power plant, the Aurora-INL, at Idaho National Laboratory, one of three projects awarded to the company under the U.S. Department of Energy's newly established Reactor Pilot Program.

"This opportunity positions us to build our first plant more quickly," Oklo (NYSE:OKLO) CEO Jacob DeWitte said. "We have been working with the Department of Energy and the Idaho National Laboratory since 2019 to bring this plant into existence, and this marks a new chapter of building."The company was awarded fuel for its first reactor in 2019, but it is awaiting authorization to fabricate its initial core at a facility that will also be constructed at INL.

Wall Street analysts are mostly bullish on Oklo (OKLO), and my boy Dan Ives reiterated his Buy rating while hiking his target to $150 from $80 in a note before the announcement, "reflecting incremental confidence in the company's nuclear growth strategy as the AI Revolution hits its next stride of growth."

When it comes to OWNING Global Data Centers, add $NBIS $APLD $CRWV $DLR on pull-backs.

And when it comes to owning the dominant hyperscalers, HOLD our TQQQ 2X Nasdaq 100 and ADD $FNGU 3X the FANG+ Mag 7 ETF

Why Own The 3X MAG 7 ETF?

Because they are responsible for over 60% of the TOTAL EPS revisions in the SP 500?? Look at this chart--and now Apple is finally growing earnings too with a strong Apple 17 release!

12. Add $AAPL Apple is ALWAYS the last to jump on the latest tech revolution--but they ALWAYS eventually bring out the best interface and functionality--and Generative AI will be no exception! The latest iPhone release in 2025 has generated significant buzz with the introduction of iPhone 17, iPhone 17 Pro, iPhone 17 Pro Max, and the brand-new iPhone Air. Here’s how the launch is going so far:

Key Highlights of the Release

iPhone 17 Series:

The iPhone 17 features a sleek new design and is powered by the A19 Bionic chip, offering faster performance and improved energy efficiency. It includes iOS 26, which introduces a revamped user interface and enhanced customization options.

The iPhone 17 Pro and Pro Max models boast periscope zoom cameras, advanced AI processing, and Titanium frames, making them lighter and more durable.

iPhone Air:

Apple debuted the iPhone Air, a new model with a breakthrough ultra-thin design, targeting users who seek portability without compromising power. It features AI-enhanced photo editing and USB-C connectivity.

Market Reception

Pre-orders: All models are available for pre-order and have seen strong demand, especially for the Pro Max, which is popular among photography enthusiasts. Pre-orders began on September 9, 2025, and devices will start shipping on September 19, 2025.

Consumer Interest: The iPhone Air has gained attention for its unique design, while the Pro models are praised for their professional-grade camera capabilities.

Conclusion

The new iPhone lineup has been well-received, with substantial pre-order numbers and excitement around innovative features like periscope zoom cameras and the iPhone Air’s design. Apple’s focus on performance, design, and AI integration continues to resonate with consumers.

IMHO, your core tech holding should be the 3X MAG 7 ETF $FNGU bought on 5%-10% + dips incrementally.

PS: Here is a free link to the Barron’s article where this graph came from

Your Next Action to Take: As mentioned, we are adding an entirely new macro ecosystem of AI direct and AI indirect beneficiary microsectors and subsectors — but we are not in a rush!

Key point: You and I MUST assume that at SOME POINT we will get a much-needed and healthy “digestion phase” of the AI stock melt-up AT SOME TIME with the blockbuster news from Oracle--and yes, we will get to that massive news in a bit.

Note: We had Ed Yardeni on my streaming business talk show, Money Mavericks last week (it's on ALL the major streaming networks BTW like YouTube etc). He sees a 25% chance of a market meltup to SP 500 7500+ and a 20% chance of a melt-down correction — I will not pretend to have any more insight than Dr. Ed. Here is the interview.

https://youtu.be/fEUVhcKZWuY?si=0LQszHhOz6R-yhe4

But as a wise man once said, “There is NOTHING so disturbing to one’s well-being and judgment as to see a friend get rich.”

Our Q4 + 2026 Game Plan: We are in the ULTRA INVESTING space, not "Value" stocks that lag badly in new global technology revolutions!

We will spread Our Bets Across ALL the Direct and Indirect AI Ecosystems--again I am with my old pal from Wedbush, Dan Ives, when he said recently:

"We believe the AI Revolution is now heading into its next stage of growth as the tidal wave of Big Tech capex spending, coupled with enterprise use cases now exploding across MULTIPLE verticals, is creating a number of AI winners in the tech world,"

Key point: We are still in a “Buy the Pull Back to 50-day Moving Average Market, but it's time to spread out our exposure to the entire generational investment opportunity that is the global race to AI supremacy.

Why? Because I cannot emphasise this enough….1) While more than 66% of the TOTAL stock market value growth has come from A.I. associated companies since May 2023 . . .

2) . . . And our TR Ultra Growth AI Data Center Tech Stack (and 2X gold miner ETFs $GDXU & $JNUG--both of which outperformed AI stocks this year--who knew??) is up over 293% or 2.9X since early May 2023 (with the 10X upside profits we took from selling SMCI in January 24 @$110 from $9.23 split adjusted from May 15 2023)

3) While the SP 500 is up just 59.36% since May 2023 (5,911 to 6,512)

Yeah, we are taking a victory lap -- we CRUSHED the S&P 500 by 4.8X!

I learned LONG AGO that if you don’t celebrate victories in the stock market investing game, you don’t understand how capricious the stock market can be!

But the BEST NEWS is . . .

. . . The Global AI Data Center “Race to AGI” is REALLY just getting started! Yes, the $4+ billion Oracle AI Data center investment news + is a BIG game-changer in what Morgan Stanley research now calculates is a $2.9 trillion global/sovereign commercial race to build out AI data center capacity 2025-2028

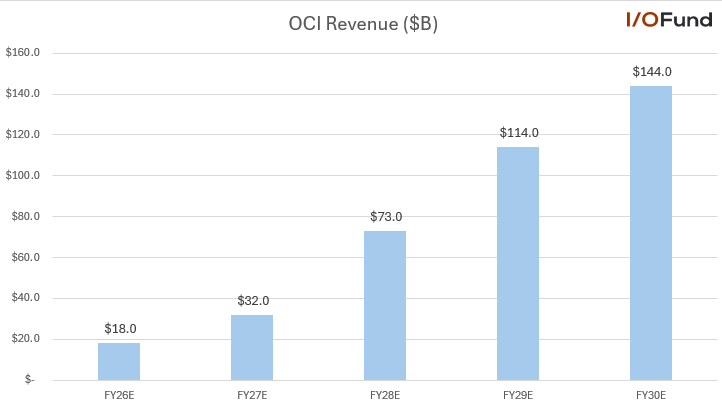

But it was the report that noted that Oracle’s remaining performance obligations (“RPO”) — a measure of contracted revenue that has not yet been recognized — had jumped 359% from a year earlier to $455 billion.

The company now projects $144 billion in recurring cloud infrastructure revenue for the 2030 fiscal year, up from $10.3 billion in fiscal 2025. Chief executive Safra Catz (who just got replaced by the EVP of Oracle Cloud Infrastructure and EVP of Global Business Units) announced that the company signed four multibillion-dollar contracts with three different customers in the quarter--with OpenAI/Stargate the biggest client of all.

And of course, we were about to add Oracle to our buy list after the employment revisions were announced on Tuesday — doh!

But Oracle is NOT THE REALLY BIG News That is Driving the $2.9 Trillion Private/Public/Sovereign AI Data Center Spending Orgy

CNBC posted an essential insight into why the global AI Revolution is DIFFERENT than past global technology revolutions: As such, the massive global build-out of GPU and ASIC based LLM infrastructure and LLM Models is now transitioning (as we expected) to “inferential AI” that actually delivers HIGHLY valuable content and answers to problems literally in a minute of computing time or less (maybe there is hope for Verses AI Genius inferential software platform after all --):

Action to Take: Oracle is the New NVIDIA! Buy Oracle ORCL UNDER $325 or better with a $550 target.

FACT: you can now multiply the $4 billion Oracle AI spend by 725X, i.e. $2.9 TRILLION 2025-2030, to understand how MASSIVE the Private/Public/Sovereign AI spend is happening every day around the world

And today is just Tuesday, 9/23/25.

So how do you and I (and of course our Transformity Wealth Management clients ) build the most NEW WEALTH possible from the upcoming $2.9 trillion Global AI spend 2025-2030?

IMHO, we now have to

1) Think of the global AI investment opportunity in terms of a set of technological “micro ecosystems” to earn as much wealth as we can in this generational wealth-building event.

2) Expect the melt-up scenario much more than a 20% meltdown scenario--but

3) BE OPEN to either scenario, ie, BUY ANY MELTDOWN dip!

4) Dip a 25% “toe in the water” in these new positions (except our new silver positions)

5) COMPLETE the position on an inevitable AI scare from people who can’t do math and/or a MUCH-needed 10-20% digestion pullback

The Oracle & Open AI $4 billion AI Spend Is Pretty Amazing-BUT Look at the

$2 Trillion of MORE AI Data Center Spending Worldwide!

Could you reflect on the USA's spending on cross-country railroads, the Industrial Revolution, the Interstate Highway System, and most recently, the Internet, from 1993 to 2002?

The chart above shows the $4 TRILLION global AI data center spend to 2030.

Of course, the race to true Artificial General Intelligence, or AGI, refers to hypothetical AI systems with general intelligence similar to human intelligence. In theory, AGI will be able to carry out any intellectual task a human can and adapt to new, unseen tasks without needing retraining.

Blah blah. For the present, let's assume AI is just a “normal” technology upgrade, albeit with significant ramifications nonetheless. Thus, for the present, the difference between inferential AI and training large language models (LLMs) lies in their purpose, process, and application, which is the key benefit of the Global AI Technology revolution. Inferential AI

Definition: Inferential AI refers to the process of using a trained AI LLM model to make predictions, generate responses, or infer outcomes based on input data. This is the stage where the model is deployed and actively used for tasks.

Purpose: The goal is to apply the knowledge encoded in the AI model to solve real-world problems, answer questions, or perform tasks.

Process:

The AI model is already trained (pre-trained or fine-tuned).

It takes input data (e.g., user queries, images, etc.).

It generates outputs (e.g., predictions, classifications, text generation, etc.) based on patterns learned during training.

Example: When an LLM like GPT-4o generates text responses based on user input, it is performing inferential AI. Similarly, AI systems that predict stock prices or diagnose diseases are examples of inferential AI in action. Training LLMs

Definition: Training LLMs is the massive data computing process of teaching a model to understand and generate human-like text by exposing it to vast datasets and optimizing its parameters through machine learning techniques.

Purpose: The goal is to create a model that can understand context, learn patterns, and generalize knowledge from training data.

Process:

Pre-training:

The model is trained on a massive dataset (e.g., books, websites, articles) to learn general language patterns.

Techniques like supervised learning and self-supervised learning are used.

Fine-tuning:

The model is further trained on specific datasets tailored to particular tasks or domains.

This refines its understanding and improves its performance for targeted applications.

Optimization:

Techniques like gradient descent and reinforcement learning are used to adjust the model's parameters to minimize errors.

Example: Training GPT models involves exposing them to billions of text samples to learn grammar, semantics, and context.

Key Focus: Data quality, computational resources, and model architecture.

Key Differences

Aspect Inferential AI Training LLMs Stage Post-training (deployment phase) Pre-deployment (development phase) Objective Solve tasks using a trained model Build and optimize the model Data Usage Uses input data for inference Uses large datasets for learning patterns Computational Requirements Relatively lower (focused on inference) Extremely high (requires GPUs/TPUs for training) Example Chatbot answering questions Training GPT models with text corpora

The Capital Allocation Genius of the Oracle “Data Center Light” Strategy.

What I mean by “AI Data Center Light” is that Oracle doesn't own the physical data center; they own the AI Data Stack technology inside the Data center. This is great news for physical data center owners and for all those involved in the AI Data Center Tech Stack, and particularly for the Optical Networking Stack. Oracle CEO Safra Catz said in the earnings statement that the company signed four $multibillion-dollar contracts with three different customers in the quarter. OpenAI noted during the quarter that it agreed to develop 4.5 gigawatts of U.S. data center capacity with Oracle.Oracle’s remaining performance obligations, a measure of contracted revenue that has not yet been recognized, soared to $455 billion, up 359% from a year earlier.

im Wood from TD Cowen, whom I follow, said the RPO figure is “just really amazing to see.” On the earnings call, he asked CEO Catz for more clarity on the cost to the company of building out the necessary infrastructure to service those customers. Catz said that one difference between Oracle and some of its rivals is in the way it handles the property that houses its data centers.

“I know some of our competitors like to own buildings,” she said. “That’s not really our specialty. Our specialty is the unique technology, the unique networking, the storage — just the whole way we put these systems together.” Key Point: The big hyperscalers Meta/Amazon (AWS)/Microsoft (Azure)/Google (Google Cloud), he said, have instituted a strategy of “offloading their capacity to other data center providers.”

That’s leading businesses to use Oracle. “These are not organic customers to Oracle,” said Luria, who recommends holding the stock. “This is Microsoft, Google and Amazon’s AI Data customers that will use Oracle capacity.”

Key Point: Again are adding $ORCL to the Ultra Growth AI Data Center Tech Stack--Buy Under $325 or better--let the stock come back from the meltup

Key Investment Point #2--It’s ALL About The AI INFERENCING, Baby. Many analysts were so impressed with the guidance that they raised their estimates on the stock. Bank of America even upgraded Oracle to buy afterward and called for more than 50% upside from Tuesday’s close. I agree! Here again is the four-year revenue ramp for Oracle (print this out an paste to your PC!)

In an interview with CNBC’s “Fast Money” after the report, D.A. Davidson analyst Gil Luria called Oracle’s projected cloud revenue figure “absolutely staggering,” and said it represents a tenfold increase in the next five years. And that revenue, my friends, is JUST Oracle!

Historical note: I started my first investment research firm, ChangeWave Research (sold to SP Global), by assembling a network of SME’s aka Subject Matter Experts to figure out where the sweet spots to invest in the “Great Internet Revolution.”

We brought in a gentleman named Paul Carton, who had previously assembled expert groups in the political world (ChangeWave Research was founded in Bethesda, Maryland, within Phillips Publishing).

We broke the key parts of the “Internet Tech Stack Ecosystems” and proceeded to make a fortune for ourselves and our subscribers--new life-changing global technology stock market melt-ups will do that (God bless our Microstrategy/JDS Uniphase/Dell/Cisco/Sun Microsystems/AOL rocket ship positions--they built two new homes for yours truly!).

We also learned an expensive lesson when that bubble burst (as in "sell first and ask questions later").

BUT the big lesson I learned about finding the best investment opportunities in a global technology revolution is to break the new macro technology ecosystem into separate “micro” ecosystems.

And boy, the direct and indirect AI microecosystems are huge!

The REALLY Key AI Investment Strategy 2025-2030: Pick The Winning Technologies & Companies OUTSIDE & INSIDE The AI HyperScaler Data Center Ecosystem “STACK

Note: In order to win the most significant AI data center hyperscalers' business, Oracle AI’s “Agentic AI-as-a-Service” business model HAS TO HAVE THE BEST technology--period.

IN Part 2 of our much-expanded Global AI Data Ecosystems Investment report, we will identify the critical technology ecosystem components of a winning AI Data Center Light Strategy to win the business of the aforementioned Global Hyperscalers' “Inferential Agentic AI-as-a-Service” providers.

MUCH MORE to come!

P.S.: We are sharing this email with both current and former subscribers. IF you are NOT a subscriber who has crushed the SP 500 by 500%/5X since May 2023 with our AI Data Center portfolio--you can subscribe for the next 12 months for less than $100--we are adding dozens of new Ultra Growth stocks and ETFs over the next year--subscribe here!!