April Newsletter Part II ALERT: Where Is The Market Bottom? Sadly But Realistically A LOT LOWER

OK, these last weeks since April 2 have been batshit crazy, and my 18-hour days have been a HUGE time suck--but when a bear market battle arrives, you suck it up.

This April newsletter is Part II, but Part III will be long enough to address the vast destruction of economic and geopolitical norms we have used to very successfully invest in stocks over the last 25 years with ChangeWave Research and now Transformity Research.

So buckle up, buttercups :)

First, the one day of hope on April 9 with the 90-day pause on tariffs ex-China does not mitigate the insanity of Donald Trump’s tariffs and their meltdown effects on the global economy. April 9 was nothing but a MASSIVE algorithmic historic short squeeze, obviously.

More obviously, the bear market for tech stocks we are now in is 100% due to the shock and awe of the POTUS PURPOSELY starting a Global Tariff War with our sacred NATO Allies in 2025 and then the second-largest GDP in the world and #1 exporter of goods to the United States, aka China. The result of this is that most investors and money managers (including me) are tearing up our standard investing playbook.

Remember, the oversold high beta stocks were POISED to take off IF Trump came to his senses on tariffs, aka “The Art of the Deal,” which I initially assumed he would—until the 145 %+ tariffs on China imports plan was announced.

But just 10% on EVERY other trade partner + 145% to China, our largest import country, comes to an effective 27% TOTAL tariff rate, which is the highest rate since 1903!!

Remember, a tariff is a euphemism for a TAX PAID AFTER the tariff is FIRST PAID by the importing company and then recouped by product price increases (don’t get me started on coffee prices sure to skyrocket—time to short Starbucks?).

Key Point: 1) We are NOT YET CLOSE to reloading high-beta growth/AI tech stack stocks until we get a tradeable bottoming event, which is either when the Trump Tariff War gets scaled back OR the US stock market gets 100% washed out.

The good news, if any, is we are getting closer to a washed-out market--look at weekly highs and lows from last week (I have tracked this in Weekend Barron’s for decades--these numbers are VERY close to the Pandemic and GFC crisis of 2008).

But the bad news is that, as we learned from the GFC and the Pandemic, stocks can fall 40-50% in panics—and this time, as mentioned, the Fed has not cut interest rates 200 basis points and has not sent stimulus checks.

2) As you can see, Wall Street analysts were not expecting a Global Tariff war either:

The 10% short covering orgy on April 9 exhausted itself at S&P 500 Index faced key resistance at the 5500 level, while both the 50-day and 100-day moving averages have now violently moved DOWN THROUGH the SPY 200-day moving average INTO A HISTORIC Bear Market "Death Cross" (ie the best signal of a bear market headed lower).

Worse--fundamentally, the S&P 500 Index is facing the Q1 earnings season almost entirely blind. The EPS guidance odds for most companies will be to guide lower or withhold guidance.

Either way, equity analysts will likely sharply reduce their earnings growth for the rest of 2025.

Key Point: Until the labor market weakens, the Fed Put is irrelevant. My near-term outlook is high volatility, and the next move is likely to revisit the bottom near the 5000 level.

NOTE: IF the SPY 4800 level does not hold, the next key support is 4400.

VERY Key Point: Assuming a 10% SP earnings decline for 2025 (I am being generous) and applying the ordinary P/E ratio of 14.5x, the market in 2025 would be down 47% for the year at 3132.

THAT IS MY worst-case scenario. NOW we would have to assume that JayPow and team WOULD HAVE TO step into the market and use “their tools,” aka buy a few $trillion of US stocks and pump $trillions into the banking system like they did in the Great Financial Crisis to make sure the US does not experience another 1930s-like depression.

And we know that because NO FED Chairman wants to be in the history books as the person who COULD have stopped a depression but failed.

Sound farfetched? What caused the 30’s Great Depression in the United States?

It was the heinous USA Global Tariffs instituted in 1930, aka the famous Smoot-Hawley tariffs. Only WWII got the US out of its worst modern-age economic depression.

Is this kind of depression likely to occur in 2025? You tell me--I thought Trump would blink when the US stock market lost $4-$5 trillion in a few weeks.

So far, no blink.

The Tariff Chaos Playbook

Okay, so while watching the Masters this weekend, I reviewed the market action, aka the “tape” of stock action in America’s Tariff War Chaos, to put together the “What’s Working Now” stock sectors.

But in the end, what is “working now” is our Tariff Chaos Portfolio—for some very obvious reasons. Yes, consumer staples like Coke and Kroger food are holding up, and business staples like Cintas uniforms and payroll systems like Paychex are holding up.

But as I mentioned above, we must expect EPS multiples to contract in a recession—that means lower prices for consumer and business staples, too. We should expect multiple compression in the Q1 earnings calls because I don’t think ANYONE has an economic model that can accurately forecast the odds of an American GDP recession when the President changes his mind about tariff rates and targets every 24-48 hours.

Will the 1000-point recovery make the April low in the market for the year? Flip a coin--if you don’t like the market today, tomorrow is very likely to be the exact opposite.

And what is insane about Trumponomics and starting a global tariff war is that, at the 5000-foot level looking down on the world and the US economy and financial markets—let me be 1000% clear—it is quite literally IMPOSSIBLE to pay down America’s $36 TRILLION of total debt—including the $1.3 trillion we have borrowed this year and the $28 trillion Treasury Bond market—with tariffs. It is literally mathematically impossible.

The biggest reason for recession risk is that NOBODY can accurately forecast until we have at least 3+ months of POST TARIFF data, starting in May and continuing through the summer. But don’t fall for the “tariffs are strategic BS”-- tariffs are a TAX, and $trillions+ of higher taxes added to an already slowing US economy = a very HIGH CHANCE of NEGATIVE US GDP growth in the last half of 2025, aka a recession, ok?

And oh yeah,

A) The Fed at this point CANNOT jump in and save the world (because tariffs on goods are a TAX and thus INFLATIONARY, of course). Federal Reserve Chairman Jerome “Call Me Jay” Powell warned investors today at the Economic Club of Chicago that “trade tensions may undermine employment and price stability,” while signaling that he’s in no hurry to soothe investors. In other comments at the Economic Club of Chicago, Powell said there were few precedents to guide thinking on President Donald Trump’s tariff offensive and that the economy will likely be “moving away” from the central bank’s goals, “probably for the balance of the year."

No shit.”

Today the S&P 500 sank 3.0% as OUR haven assets, including our bond funds and our favorite asset class, gold and silver, rallied. My managed portfolios today were ALL GREEN on a day of scorching red.

Key takeaway: Many had assumed that the Fed would prioritize the labor side of the mandate if forced to choose, but he suggested TODAY that price stability is necessary to maintain a healthy labor market

Thus, if you’re waiting for a Fed put, you should IMO set your sights on a lower strike price as long as inflationary pressures remain elevated—aka the pain point that the central bank would step in to avert a broad stock crash.

In short,

Don’t look to monetary policy for market support anytime soon--we are on our own, and the Fed is okay with that.

There are no FISCAL bullets from the government to stimulate the US consumer spending like the pandemic, and let’s face it

The US is coming off 15 straight YEARS of near-zero interest rates. The globalization of manufacturing to export the LOWEST VALUE LABOR COSTS (which ironically keep product inflation rates DISinflationary)

America under Trumpism has now given way to American nationalism and market protectionism at a level the modern world has never seen.

Note: even AI can’t yet make a dent in reshaping the US economy and reducing labor and production costs—aka vastly improving PRODUCITIVITY!

And here is another market conundrum. In a global economic panic, US Treasury bond yields are ALWAYS DOWN as bond prices go higher—aka the “safety trade.”

But today, they are not. Given the subdued inflation rates, falling consumer confidence (off a cliff as measured last week), and multiple signs of a weakening economy, Treasury bond rates SHOULD BE FALLING, not rising!

This economic conundrum is why I added ALL those gold and silver plays last Monday.

Key point: With the economic insanity of ONE MAN obliterating the global order of developed countries' trading partners, The US Bond Market is NOT THE SAFE HAVEN it has been since WWII--and if you don’t want to own dollars in your central bank, you seek the SAFETY of gold bullion (and silver rides gold’s coattails).

And unlike the Plaza Accord agreement of 1985 (when we had positive relationships with the five largest economies in the world)-we now have a TRADE WAR with the most prominent importers into the US economy.

The Plaza Accord 101

It was reached on September 22, 1985. It was an agreement among five major economies: the United States, Japan, West Germany, the United Kingdom, and France.

Key Objectives and Outcomes of the Plaza Accord:

Currency Depreciation: Ironically, today, the primary aim of the Plaza Accord in 1985 was to depreciate the U.S. dollar in relation to the Japanese yen and the German Deutsche Mark. This was intended to help reduce the U.S. trade deficit by making American exports cheaper and imports more expensive.

Coordinated Intervention: The agreement involved coordinated intervention in currency markets by the participating countries' central banks. They agreed to sell dollars and buy other currencies to influence exchange rates.

Impact on Trade: The significant dollar depreciation led to an increase in U.S. exports and a decrease in imports, which helped to narrow the trade deficit over time.

Today, our largest trading partners are selling the US dollar (i.e., it is depreciating in purchasing power) while tariffed imported goods are inflating in price.

Since I know from interviewing DJT for Fox Business that he proudly “does not read books,” can someone at Fox News do a segment on how NEGATIVE a Tariff War is in 2025?

The New Tariff Chaos Playbook To Come

At some moment in this bear market, when gold peaks at $3600-$400, it will be appropriate to be more aggressive with secular growth stocks and non-cyclical industry leaders again as the Fed and Trump will HAVE TO CALL UNCLE.

On our list of non-tariff stricken industries and companies will be:

1) Those companies that sell non-discretionary consumer and MUST HAVE products and services (ie, not NICE TO HAVE discretionary things and services except for the Top 20% of US households that account for 90% of discretionary spending on goods and services)

2) That sell and provide non-discretionary enterprise/ corporate/small business services + non-discretionary digital business management platforms

3) Banks and Insurance Companies + Insurance Brokers with large bond portfolios

But not yet.

However, check in with me tomorrow because the whole Trumponomics chaos may change for the better or the worse every day, and right now, there is nothing for bulls to hang their hats on for a new 2025 bull market.

The Reality Today: The Golden Age of America is NOT Happening

In reality, as we all know, global stock markets are tanking; economists are inflamed, dazed, and confused, and money managers like me who saw this shit show coming THANKFULLY have our portfolios in ultra-stable bond funds/gold and silver ETFs (precious metals rise in price as the US $dollar tanks in value) that we advised you take early last week and are SHORT the most overvalued QQQs via call options on $SQQQ 3x short the QQQ ETFs.

Key Point: Here is a GREAT analysis of what the China/USA tariff war from Bloomberg--give it a watch right now

https://www.bloomberg.com/news/videos/2025-04-10/why-trump-unleashed-tariff-chaos-video?sref=885uV7K8

Our Defense Is The New Offense Portfolio is FLYING HIGHER

Look—I have learned many lessons in 40 years of capital markets and fund management. One is that stocks ALWAYS go down farther and faster than we can imagine—see the Great Financial Crisis, which dropped nearly 50%, or the Pandemic, which dropped 40%.

Two is that when stocks go down so fast, dead hedge funds with massive 10X leverage in stocks and bonds are puking up and selling everything to meet margin calls. That is called “selling that begets more selling.”

Three, it’s the FINANCIAL crises that cause the deep stock market routs. And the nearly 10% massive short covering rally on April 9 is NOT a “new bull market”-it was an automatic algorithm event (84% of trades were momentum algorithms)

Four, the S&P 500 Index’s best days in history were almost always short-covering events, and six months later, the SP 500 index was only higher in six months 43% of the time.

KEY point: But when there was a financial system meltdown (or war), it took 4+ YEARS to recover its pre-meltdown valuation.

And now, THE LESSON of 2025 (and 1898--and 1930) is once again that NO ONE WINS a tariff war, and THIS TIME, the Fed's hands are tied because TARIFFS are inflationary (not like the GFC or Pandemic).

And the final straw?? The Federal Government--who has CAUSED this stock market shit show-- can’t inject a few $trillion in liquidity into the US economy like the GFC or Great Pandemic because all those $trillions of 10-20 year bonds at 1-2% interest rates are COMING DUE NOW will be refinanced at 5% or higher rates.

What Does China Want?

According to a person familiar with the situation, China, not surprisingly, wants to see a number of steps from Donald Trump’s administration before it will agree to trade talks, including showing more respect by reining in disparaging remarks by members of his cabinet.

Beijing also wants the US to appoint a point person for talks.

Meanwhile, China’s economy showed surprising strength in early 2025 with a sharp uptick in March, though the trade impasse has still prompted calls for stimulus.

US futures and European stocks bounced off the report China is open to negotiations. However, trade policy still weighs heavily on global technology stocks as new US restrictions on the export of Nvidia chips to China and a disappointing report from Dutch chip-equipment maker ASML fanned concerns.

PS Trump launched a probe into the need for tariffs on critical minerals. The investigation, led by the commerce secretary, will evaluate the impact of imports of these materials on America’s security and resilience. As geopolitical and trade tensions rise, these are the seven rare earth metals you need to know.

The TR Ultra Growth TARIFF DEFENSE Portfolio is ROCKING!

So again--let’s use a $100k portfolio and play TOTAL DEFENSE until Mr. Trump hopefully blinks and sees (but of course will not admit) that he single-handedly caused the DREAMS and PLANS of tens of millions of retirements or savings for new homes to go up in smoke.

Market Assumption: The US bond market and US dollar will continue to slowly crumble in value unless Trump "settles" for 10% tariffs across the board and comes to an agreement with China 90% below the 145% tariffs and the net 27% global tariff rates.

30% ZERO RISK Short Term Bond Funds near 5-7% ish

$JBBB $GGN $ZTR $SRLN $BILL $BOXX $USFR $SGOV

Or Vanguard Bond Funds (very low management fees) VBIL VGUS VPLS VBIL VCRB

Reinvest high monthly yield $CRSH $NFLY $YQQQ $GGT $GLDI (30%+ dividend) that average out to +25% annual dividends, and none related to China except the short position on TSLA $CRSH (as TSLA sales are cratering there).

40% LONG GOLD & Silver $SILJ $SLVO $GDXJ $GDXU $GDXY (30%+ dividend) and NEW PLAY $JNUG +Short High Beta with $HIBS and SHORT Energy $WTID. ,

Finally here are some critical updates on your Transformity Research subscriptions.

Since we had many problems getting our digital systems back up and running. We have renewed over 70% of our TR Ultra Growth and All-Access subscriptions—way above average for the investment research publishing world. We have extended the non-renewed subscriptions to April 20,

Here is the subscription link for TR Ultra Growth renewals --1 and 2-year subscriptions--gett'r done

The same goes for All-Access memberships—we will close the existing All-Access Discord Trading Room EOB on or near April 20 and send new invitations to those who have renewed their one-year or two-year All-Access Pro subscription (which now includes TR Ultra Growth and Ultra Monthly Income subscriptions!).

Here is the All-Access PRO subscription renewal link One Year

Note: The renewal system is working perfectly now--but if you are still having a problem getting in, EMAIL Gary The Tech Support Guy at gary.hlusko@gridtech.io

2) We extended ALL 2024-2025 Ultra Growth renewal subscriptions to START April 1, 2025 (as recompense for our digital transfer nightmare!).

Again here is the TR Ultra Growth renewal link to renew before the April 20 cut-off!

TR Ultra Income Service--Starts Tomorrow! (better late than never!)

But Here is The BEST Way To Greatly Increase The Value of Your Portfolio in 2025-2026(or your monthly income by $10-$12,000 per month) during the daily confusion of Government By Tweet --put a few hundred grand into our new TR Ultra Monthly Income advisory that now launch early next week!

YO--the value proposition for TR Ultra Monthly Income as we get to a REAL tradable bottom in the MAGA Market Beatdown in the next few months at just $149 bucks a year is UNHEARD OF & AMAZING. . .

You could get just one bottle of Marjorie's favorite Sancerre and two bottles of my favorite Cabernet, my cousin Barr's St. Helena 2017 Barlow Cabernet.

OR YOU could subscribe to TR Ultra Monthly Income Advisory and get the formula and portfolio advice that, with just $300,000 invested:

A) earns you over $10,000 PER MONTH in our carefully curated TR Ultra Monthly Income newsletter. . .

B) With @ $400,000, you are earning @$12,000 per MONTH

C) All while being hedged against a 10%+ correction with put options on 2-3X leveraged ETFs

But the really big opportunity for you today is this: By simply reinvesting your monthly dividends, you create a Super Wealth-Building " Feed-Back Loop" where you DOUBLE your $400,000 to $800,000 (or $100k or $5 million) EVERY 34 MONTHS (and that doubling in 34 months assumes zero net appreciation!)

Here is the math for you math nerds (or just ask your favorite AI Chatbot--my fave by far is Google's www.MONICA.com )

Since you are receiving $12,000 a month, you can calculate how many months it will take to reach the additional $400,000 needed: Amount Needed=T−P=800,000−400,000=400,00

12,000≈33.33 months Months=D Amount Needed=12,000 400,000≈33.33 months

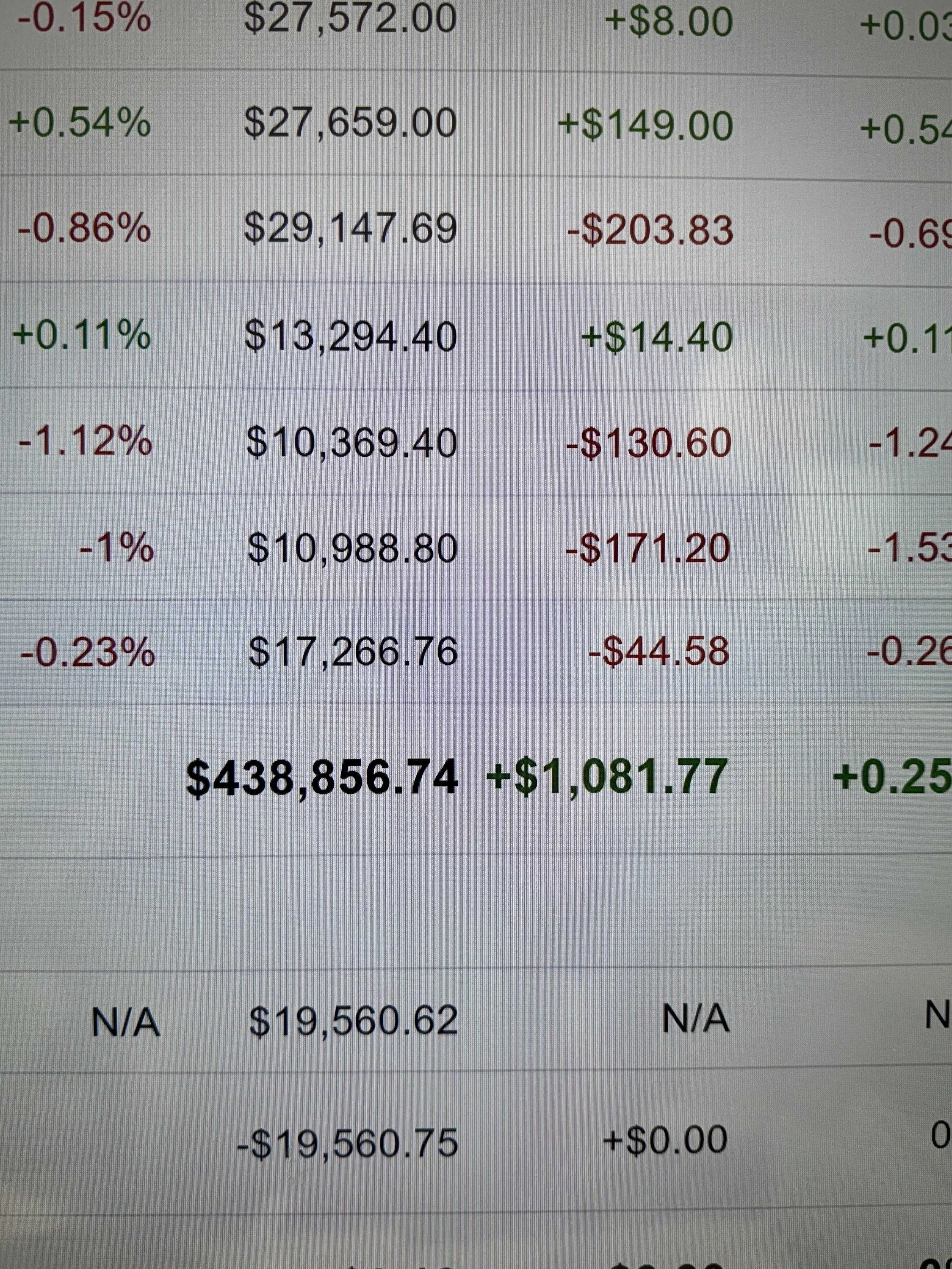

This is why you should subscribe to our new TR Ultra Monthly Income service!And here is the TR Ultra Monthly Income PROOF! We have dozens of wealth management clients that look like my March Schwab Dividend Statement in my ROTH—and ALL THAT INCOME IN A ROTH is tax-free (and a few of our $1 million+ asset management clients are generating 3X-5X times this measly $12K--do THAT monthly dividend math!).

PS—In a Roth/IRA/Corp Pension Plan, we just reinvest the dividends tax-free until the client wants to start taking monthly income that THEY NEVER IMAGINED they would hit their checking account every month!

Capiche? Here is the subscription link for TR Ultra Monthly Income, which we launch this coming Monday: years for $149 one year/$197 two years OR $498 All Access PRO One Year, which includes TR Ultra Growth/Ultra Monthly Income and our All Access Discord trading room

Final Thought: Again, I strongly advise you not to confuse your politics with portfolio management. You may 100% agree with Tariff Trumpy that China and other countries are "ripping us off." But raising TOTAL import taxes to 27% for an economy that has been slowing its growth since March is unquestionably taking the US economy into either a GDP recession or worse stagflation.

Either a GDP recession or worse, stagflation, is the economic outcome of Trump's Terrible Global Tariff War—and it will take this bear market a lot lower than today!

Toby

Tobin Smith--Founder/CIO Transformity Research/Wealth Management/Transformity Capital Markets

Founder of ChangeWave Research (now part of S&P Global Research )/2X NY Times Best Selling Author ChangeWave Investing & ChangeWave Investing 2.0 published by Random House/Editor Transformity Ultra Growth/Ultra Monthly Income/All Access Trading Room/Managing Member TransMed One TSIG LLC/ 14-Year Contributor on Fox News' Bulls & Bears /Host @ Fox Business